FDIC-Insured - Backed by the full faith and credit of the U.S. Government

At BankGloucester, we offer a range of Certificates of Deposit (CDs) and Individual Retirement Accounts (IRAs) to help you achieve your financial goals.

Our CDs provide a secure and reliable way to earn interest on your savings over a fixed term, with a variety of options to suit your needs. With flexibility and competitive rates, you can choose the CD that best aligns with your financial plans, knowing your investment is insured in full.

For those planning for retirement, our IRAs offer a tax-advantaged way to save for your golden years. Explore our IRA options to find the account that fits your financial strategy, and take a confident step toward securing your financial future.

Certificates of Deposit (CDs) offer a higher interest rate than regular savings accounts, and help you maximize your return with minimal risk. BankGloucester CDs come in 6 to 60-month terms so you can choose what works best for you. There are no set-up charges or fees, and no penalty for interest withdrawal. If you are seeking a safe and secure way to earn interest on your money, a CD may be the right choice for you.

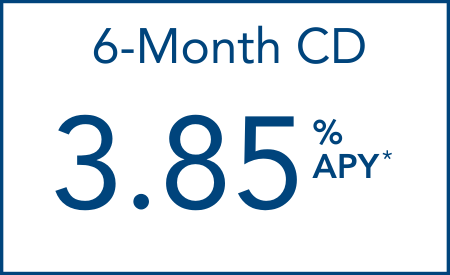

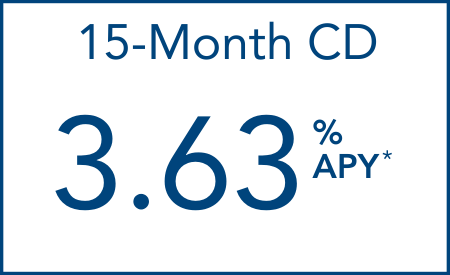

Rates Effective: November 6, 2025

| Term | Minimum Deposit to Open Account | Minimum Balance to Earn APY* | Interest Rate | APY* | Compounding Frequency |

|---|---|---|---|---|---|

| 6 Months | $2,500 | ||||

| $2,500 - $49,999.99 | 3.75% | 3.75% | Simple | ||

| $50,000.00 and over | 3.75% | 3.75% | Simple | ||

| 9 Months | $500.00 | ||||

| $500.00 - $99,999.99 | 3.54% | 3.65% | Monthly | ||

| $100,000.00 and over | 3.54% | 3.65% | Monthly | ||

| 12 Months | $500.00 | ||||

| $500.00 - $99,999.99 | 3.40% | 3.50% | Monthly | ||

| $100,000.00 and over | 3.40% | 3.50% | Monthly | ||

| 15 Months | $500.00 | ||||

| $500 - $99,999.99 | 2.92% | 3.00% | Monthly | ||

| $100,000.00 and over | 2.92% | 3.00% | Monthly | ||

| 18 Months | $500.00 | ||||

| $500.00 - $99,999.99 | 2.92% | 3.00% | Monthly | ||

| $100,000.00 and over | 2.92% | 3.00% | Monthly | ||

| 24 Month | $500.00 | ||||

| $500.00 - $49,999.99 | 3.40% | 3.50% | Monthly | ||

| $50,000.00 and over | 3.40% | 3.50% | Monthly | ||

| 30 Months | $500.00 | ||||

| $500.00 - $99,999.99 | 2.92% | 3.00% | Monthly | ||

| $100,000.00 and over | 2.92% | 3.00% | Monthly | ||

| 36 Months | $500.00 | ||||

| $500.00 - $49,999.99 | 2.68% | 2.75% | Monthly | ||

| $50,000.00 and over | 2.68% | 2.75% | Monthly | ||

| 48 Months | $500.00 | ||||

| $500.00 - $49,999.99 | 2.20% | 2.25% | Monthly | ||

| $50,000.00 and over | 2.20% | 2.25% | Monthly | ||

| 60 Months | $500.00 | ||||

| $500.00 - $49,999.99 | 2.20% | 2.25% | Monthly | ||

| $50,000.00 and over | 2.20% | 2.25% | Monthly | ||

Fees could reduce earnings. On Certificate and IRA Accounts a penalty may be imposed for early withdrawal. |

|||||

BankGloucester is pleased to offer a variety of IRA accounts. Both the Traditional IRA and Roth IRA can offer you potential tax advantages.

Traditional IRAs allow you to defer taxes on your earnings until they are withdrawn, and certain contributions are tax deductible in the tax year for which they are made.

The Roth IRA is non-tax deductible for contributions but features tax-free withdrawals after age 59 or for certain distribution reasons after a five-year holding period.

Rates Effective: November 6, 2025

| Term | Minimum Deposit to Open Account | Minimum Balance to Earn APY* | Interest Rate | APY* | Compounding Frequency |

|---|---|---|---|---|---|

| 12 Months | $500.00 | ||||

| $500.00 - $99,999.99 | 3.40% | 3.50% | Monthly | ||

| $100,000.00 and over | 3.40% | 3.50% | Monthly | ||

| 18 Months | $500.00 | ||||

| $500.00 - $99,999.99 | 2.92% | 3.00% | Monthly | ||

| $100,000.00 and over | 2.92% | 3.00% | Monthly | ||

| 24 Months | $500.00 | ||||

| $500.00 - $49,999.99 | 3.40% | 3.50% | Monthly | ||

| $50,000.00 and over | 3.40% | 3.50% | Monthly | ||

| 30 Months | $500.00 | ||||

| $500.00 - $99,999.99 | 2.92% | 3.00% | Monthly | ||

| $100,000.00 and over | 2.92% | 3.00% | Monthly | ||

| 36 Months | $500.00 | ||||

| $500.00 - $49,999.99 | 2.68% | 2.75% | Monthly | ||

| $50,000.00 and over | 2.68% | 2.75% | Monthly | ||

| 48 Months | $500.00 | ||||

| $500.00 - $49,999.99 | 2.20% | 2.25% | Monthly | ||

| $50,000.00 and over | 2.20% | 2.25% | Monthly | ||

| IRA Statement Savings | $50.00 | ||||

| $0.01 | 0.50%* | 0.50% | Monthly | ||

Fees could reduce earnings. On Certificate and IRA Accounts a penalty may be imposed for early withdrawal. IRA accounts will be charged an IRA Service Fee of $15.00 annually on December 15th. |

|||||